We have been made aware of a scam text going around claiming that members’ accounts have been ‘placed on hold’ or ‘locked’ and to click a link to verify their accounts.

⚠️ This is NOT legitimate and should be ignored. Please do not click any links⚠️

Be Fraud-Aware. Look out for red flags such as misspellings, an unusual website address in the link, and a message that tries to get you to act urgently.

- NEVER click a link from a message.

- We will NEVER contact you and request a code.

- We will NEVER email or text you to say your account is blocked.

If you think you have been scammed, please call our member services on 1800 23 24 25 immediately.

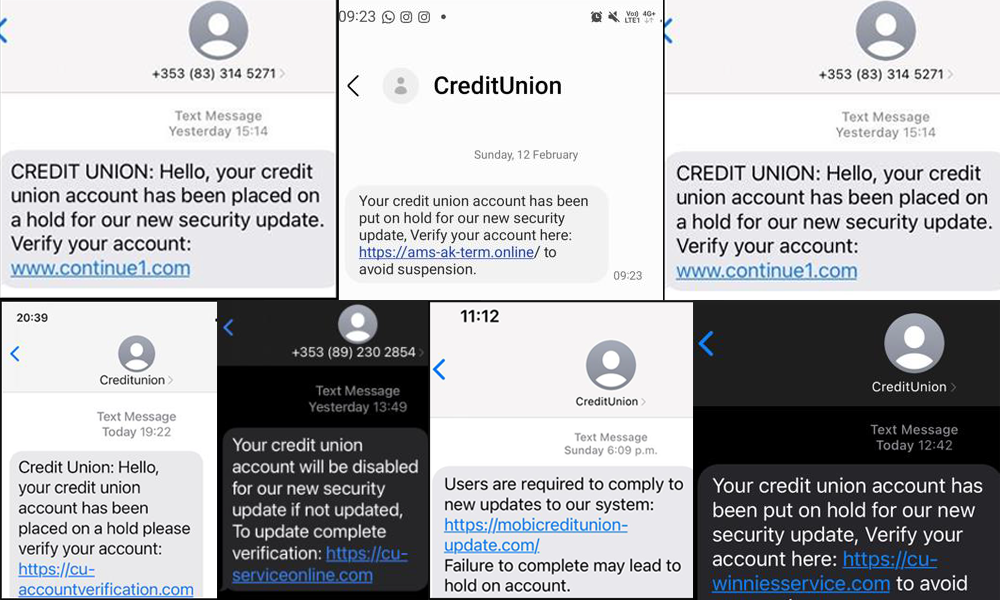

Below are some examples of recent messages received from scammers, as you can see the website URL’s are not clcu.ie, and their language tells you to act urgently by using terms such as suspension, disabled, hold, and so forth:

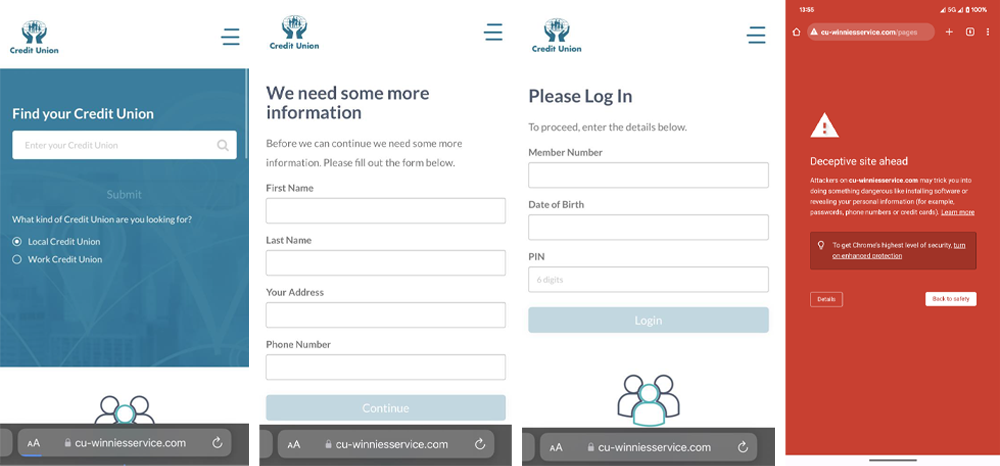

If you do click on a link and you are directed to a landing page like below, exit the page and DO NOT enter any information:

How the scam works:

- The identified Credit Union app is downloaded by the attacker – this requires activation through an SMS code.

- Subsequently, the attacker impersonates a Credit Union staff member when calling the member.

- The attacker inputs the provided information to set up the app.

- The system sends an activation code to the member’s phone via SMS.

- The attacker informs the member about sending a code to their phone and will ask the member to recite the code back to the attacker.

- The attacker ends the call and gains access to your account.

Recent Increases in Fraudulent Behaviour

We have compiled this post to alert you about the recent surge in fraud and to provide guidance on how to combat these fraudulent activities.

Fraudsters are actively engaging in phone calls where they impersonate representatives from reputable service providers. They claim that there is a need to change or upgrade your service. Subsequently, they persuade individuals to download apps like TeamViewer onto their phones or devices, giving them unauthorised access. Once they gain control, the fraudsters request the customer’s current account or card details, along with a copy of their ID, such as a driver’s license, for identity verification.

According to advice from the Gardai, falling victim to this scam results in the fraudsters downloading apps like the Revolut app. They then initiate money transfers from your current account as payment, effectively emptying your account.

Considering the increasing prevalence of this type of fraud, we want to emphasise the heightened risk of fraud threats. Specifically, be cautious of telephone calls and text messages from fraudsters posing as legitimate companies like Amazon, Eir, or DHL. They will attempt to persuade you to download apps such as TeamViewer or Revolut, which could lead to fraudulent activities. Stay vigilant and protect yourself from these scams.

How to Protect Yourself

If someone calls you, regardless of the company they claim to represent, and asks for your current account details or debit card information, or if they request you to install software or an app on your phone or computer, take immediate action by ending the call. Similarly, if you receive a text message soliciting your account information, exercise caution by refraining from responding or clicking on any links contained in the message.

Under no circumstances should you disclose your debit card details, current account information, or One-time Passcodes to anyone during an incoming call. If you have any doubts about the call’s authenticity, hang up without hesitation. Your financial security is of utmost importance and if they’re genuine, they will understand.

To protect you and your account from fraud, please follow these tips:

- Never respond to an email or text asking for financial, personal, or security information.

- Your personal details are precious – always keep PINs and passwords private.

- Don’t click on links or attachments in unsolicited emails or texts. Log into accounts and websites directly.

- Remember, your Credit Union will never ask for PIN, One-time passcodes, or security details.

- Don’t assume an email, call or text is genuine because someone has basic information like your name or address. Fraudsters use publicly available information to lure you in.

- Terminate a landline call by hanging up twice.

- Always keep your debit/credit card in sight when paying for goods or services.

- Cover your PIN every time you pay using your card and at the ATM.

- Use 4G when shopping or banking online.

- If something doesn’t feel right, it probably isn’t. Stay in control and don’t be rushed into making a decision you might regret. It’s always better to check, chat, and challenge.

Always keep your debit/credit card in sight when paying for goods or services.

- Cover your PIN every time you pay using your card and at the ATM.

- Unsecured public Wi-Fi networks are hotspots for fraudsters – use 4G when shopping or banking online.

- If something doesn’t feel right, it probably isn’t. Stay in control and don’t be rushed into making a decision you might regret. It’s always better to check, chat, and challenge.

If at any stage you provide your account information to a third party like the scenarios described above, or if you are in any doubt about a company that you have provided your account details to, contact Croi Laighean Credit Union on 1800 23 24 25 / welcome@clcu.ie or our Card Services team on 01 693 3333 immediately to advise so we can protect your account.

We hope this information helps to keep you safe from fraud. If you have any questions, please do not hesitate to contact us.

For further information on how you can keep your current account and debit card safe from fraud risks please read your fraud awareness brochure available here. Another good resource for information on the latest scams is the Citizens Information hub.

Join Us

Join Us