Green Loan for Solar Panels

Would you consider paying for 6-7 years of electricity upfront to get 15 – 20 years of electricity a good investment? If the answer is yes, then you should consider investing in solar PV panels. Our Credit Union Green Loan offers a low rate of 6% (6.17% APR) for financing solar panels.

Are solar panels worth the expense?

Solar panels can save you hundreds or even thousands of euros on your electricity bill each year. They are environmentally friendly and provide energy stability. With a median failure rate of only 0.05%, solar panels are reliable, meaning out of 10,000 panels, only 5 might fail in a year. They also have a lifespan of 20-30 years, ensuring long-term benefits.

Is Ireland suitable for solar generation?

Yes, solar panels work well in Ireland, even with its cloudy climate. They operate on sunlight, not heat, so you can generate electricity even on cloudy days. The best months for solar generation are late spring, summer, and early autumn, but you can still generate electricity during winter, though at a lower rate. Excess electricity generated in good months can be credited by your electricity provider and used during the less productive months – November, December, January, and February.

How much can you save with Solar Panels?

Savings depend on factors like the size of your solar system, sunlight received, panel orientation, and your electricity usage. Typically, you can save between 30% and 70% on your annual electricity bill. According to SEAI, a home solar PV system of 20 sq.m (~3kWp) generates around 2,600kWh yearly, covering over 40% of an average Irish home’s annual electricity demand. You can also earn up to €0.24 per kWh by exporting excess electricity back to the grid.

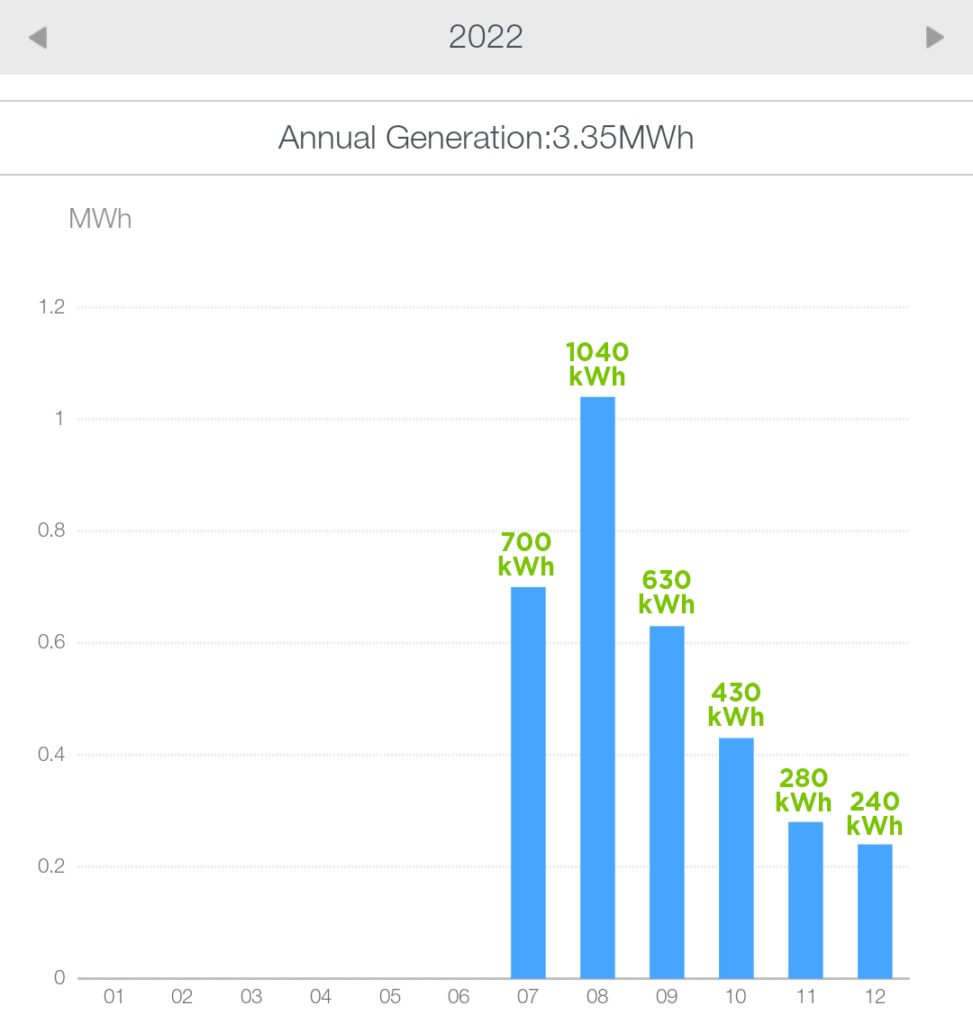

Real-world example:

A 2350 sq. ft. A3-rated home in the midlands installed a 7.4kWp solar system with a 10kWh storage battery. The system cost €12,400 after grants. From July 1st to December 31st, it generated 3,358kWh of electricity. Of this, 1,794kWh powered the home, saving €627.90, and 1,564kWh was exported to the grid, generating €328.44.

The total revenue over six months was €956.34, with the system generating about 50% of the home’s total electricity usage. The estimated timeframe for completely recuperating the cost of installation is approximately 6.5 years.

Offset Your Solar Panel Loan

Analysing your electricity usage can help offset a significant portion of a Solar Panel financing through savings from generating solar power. You save on the electricity you generate and use, and you can build up credit by exporting electricity.

Steps to Analyse Your Usage

Chart your electricity usage for the last year using your bills.

Estimate how much electricity is used during the day versus at night.

Calculate potential savings by comparing your usage to the output of a solar PV system.

Maximising Solar PV Benefits

From April to September, a solar PV system will generally run close to full capacity (or at full capacity). Using your estimated monthly usage, you can work out the cost of electricity that could be covered by a solar PV system.

Based on “standard” charging rates from Electric Ireland – the average usage of 4200 kWh of electricity a year will result in an annual electricity bill of €1756. (July 2024). If adding solar panels reduces this cost by 50%, that would equate to a saving of €878 per year. The savings could be used to fund the solar panel loan ensuring a minimal increase in expenditure. Once you pay off the Credit Union Green Loan, you start saving even more money.

At present, you can only generate a maximum of 6kWh for a standard domestic setup (connected to the grid). This does not mean that you must restrict your solar panels to 6kWp. Many people opt for larger systems as they will generate more electricity when the conditions are not optimum. If your panels are only running at 50% efficiency, then having more panels will increase your generation. However, if the conditions are optimum, you won’t be able to generate over 6kWh at any given moment.

The key to maximizing a solar PV setup is to make changes and use the electricity when it’s generated.

This might mean that you have to change your electricity usage habits. Instead of running the washing machine or dryer during off-peak times, you now run it when the sun is the brightest! If you have a hot water tank, you could invest in an Eddi. This is a solar power diverter that helps you to make the most of your self-generated power. Rather than exporting your excess electricity back to the grid, an Eddi heats your hot water with the excess power that is not used by the home. Another option is to invest in an electric car and use the excess energy to power your car.

Should you get a battery for your solar panels?

Before electricity suppliers started paying the feed-in tariff, a battery was a wise investment. This is because you could store the energy generated during the day and use it at night.

However, now that suppliers pay for excess power, a battery is not as essential. There are still some benefits to having a battery, such as the fact that you pay more for the night rate than what your provider will pay you for your excess power. It is also useful during the darker months, as you can charge your battery at a lower night rate and use it during the day. However, batteries are expensive, so you should always do the math to make sure the cost is justified.

Here are some factors to consider when deciding whether or not to get a battery for your solar panels:

- Your electricity usage: If you have a high electricity usage, a battery can help you save money by storing the energy generated during the day and using it at night.

- Your location: If you live in an area with a lot of cloudy days, a battery can be more useful, as you will be able to store more energy during the day when the sun is shining.

- Your budget: Batteries are expensive, so you need to make sure that you can afford the upfront cost.

If you are considering getting a battery for your solar panels, we recommend talking to a solar installer to get their advice. They can help you assess your needs and determine if a battery is the right option for you.

Now you have the low down on solar PV panels, and if you’re considering investing in them, please contact us about our great value Solar Panel Financing Loan! Our Green Loan can also be availed of when looking to buy an electric or hybrid vehicle and we also do other great-value loans and mortgages. Click here to find out more about our range of loans.

The information provided used an analysis of a 2022 solar PV installation. Anyone considering installing solar panels should do their own research, as all homes are different, and energy usage patterns and energy costs can vary greatly. While every care has been made in the production of this blog post, Croí Laighean Credit Union, or any of its staff, cannot be held responsible for any omissions, or errors.

Join Us

Join Us